From Stress to Success: How Financial Wellness Can Transform Your Business

By Erika Wasserman, Your Financial Therapist

Financial well-being is no longer just a personal matter; it directly impacts job performance, overall happiness, and the success of an organization. As more than 80% of CHRO and human capital leaders in PwC’s Pulse Survey expressed concern about wage growth misrepresenting inflation and declining consumer purchasing power, the need for financial wellness is on the rise. Undeniably, emotions and money are tied together. Here are the top three reasons why and how HR leaders should prioritize and actively support their employees’ financial wellness.

1. It Impacts Your Bottom Line

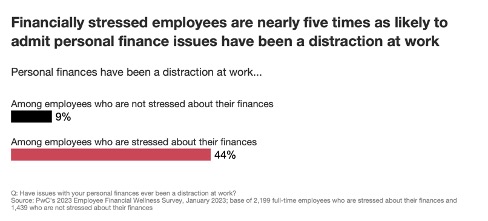

The financial stress faced by employees can significantly hamper their focus, creativity, and overall job satisfaction. When employees are worried about their financial stability, it can lead to decreased concentration, absenteeism, and even conflicts with colleagues.

By providing resources and programs that support financial wellness from a third party, HR leaders empower employees to take control of their financial wellness. This empowerment translates to reduced stress, allowing employees to channel their energy and attention towards their work responsibilities. When employees feel that their employer genuinely cares about their well-being, they are more likely to feel engaged and committed to their roles, leading to increased job satisfaction and improved overall productivity.

2. Attraction and Retention of Top Talent

This is also an investment in you, the HR leader. A 2023 survey by financial-wellness benefits provider BrightPlan of 1,400 knowledge workers at large U.S. companies found that 77 percent of HR executives report experiencing financial stress. Neha Mirchandani, BrightPlan’s chief marketing officer and head of people, said that only five percent of HR leaders answered financial-literacy questions correctly in the survey, compared to 18 percent of all respondents. In addition, nearly 62 percent of HR leaders said they had unmanageable levels of debt.

In a competitive job market, attracting and retaining top talent is a constant challenge for organizations. Beyond salary packages, candidates are increasingly seeking employers who demonstrate a commitment to their holistic well-being, including financial wellness. HR leaders who recognize this trend and take proactive steps to address it will gain a competitive advantage in talent acquisition and retention in both the overall company and their own personal team.

When an organization is known for its robust financial-wellness programs, it becomes an attractive destination for prospective employees. Job seekers are more likely to choose an employer that offers support and resources to navigate physical challenges, as well as financial challenges. Moreover, once onboarded, these employees are more likely to stay with the organization, as they feel valued and supported. High turnover rates not only disrupt productivity, but also lead to increased recruitment and training costs. Therefore, investing in financial wellness is a strategic move that directly impacts an organization’s bottom line by curbing turnover and fostering a loyal workforce.

3. Positive Organizational Culture and Reputation

Three out of 10 employees, even among those who earn $100,000 or more per year often or always run out of money between paychecks, which leads to personal stress, sick days, and irritability. HR leaders have a unique opportunity to shape the culture by prioritizing programming in this area that employees see as accessible, valuable, and impactful. When employees perceive that their employer is genuinely concerned about their financial health, it creates a positive atmosphere of trust and support.

Furthermore, when employees experience positive outcomes from financial-wellness programs, they are more likely to become brand advocates. Satisfied employees share their positive experiences with friends, family, and professional networks, enhancing the organization’s reputation. A reputation for caring about employee well-being can attract not only customers, but also potential business partners and investors who align with the organization’s values.

The topic of money is often a sensitive one for people to talk about and clients often say, “I don’t feel comfortable talking to someone in-house as it might create an impression that I am financially unstable or make poor decisions.” By working with a Certified Financial Therapist with global reach, education, tools, flexibility, and scalability it gives you access to top talent in this needed and growing field.

Conclusion

In the dynamic landscape of modern HR, financial wellness has emerged as a critical concern that HR leaders cannot afford to ignore. By addressing employees’ financial stress, organizations can unlock invaluable benefits, including enhanced productivity, improved talent attraction and retention, and the cultivation of a positive company culture. By empowering employees to achieve financial stability and peace of mind, HR leaders lay the foundation for a thriving workforce and a resilient, future-ready organization. As we navigate the evolving landscape of work, one thing remains clear: supporting employees’ financial wellness isn’t just a choice — it’s a necessity.

Erika Wasserman is founder and CEO of Your Financial Therapist, which focuses on corporate wellness, personal wellness, and couples’ financial wellness. As a Certified Financial Therapist CFT-I™, a sought-after certification held by only 70 people in the world, she combines her education in finance and international economics with her passion for helping others, empowering individuals, couples, and companies to reshape the way they think about money. Erika can be reached at [email protected].